Monevo

by Mel

Jun 10, 2020 |

0

Votes |

27

Used |

0

Reviews

by Mel

Jun 10, 2020 |

0

Votes |

27

Used |

0

Reviews

-

rate

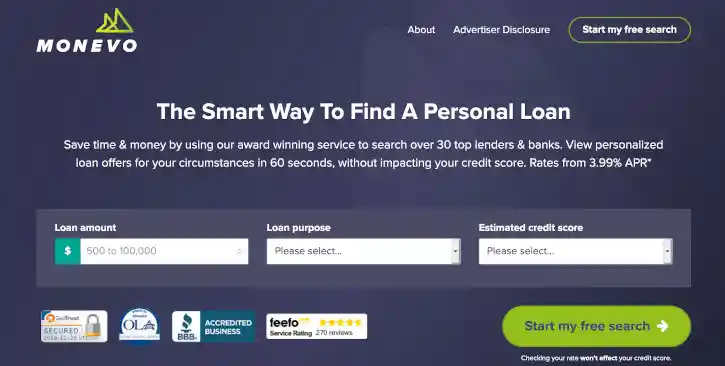

Monevo is a highly-rated, critically-acclaimed, and multi award-winning online peer-to-peer personal loan comparison platform. Europe’s largest lending marketplace, Monevo is now available in the US for loan applicants to search for personalized loan offers from over 30 top US lenders and banks in just seconds.

-

rate

Monevo is a highly-rated, critically-acclaimed, and multi award-winning online peer-to-peer personal loan comparison platform. Europe’s largest lending marketplace, Monevo is now available in the US for loan applicants to search for personalized loan offers from over 30 top US lenders and banks in just seconds.Apply Now Similar Sites Used

People Also Applied For

Summary

Monevo is a highly-rated, critically-acclaimed, and multi award-winning online peer-to-peer personal loan comparison platform. Europe’s largest lending marketplace, Monevo is now available in the US for loan applicants regardless of their credit scores to search for personalized loan offers from over 30 top US lenders and banks in just seconds.

What You Get

Remember the days where the only way you could get a loan was to go to your local bank and sit down with a loan officer—or worse—endure the exorbitant interest rates from a sketchy loan shark? With most services now going online, there are dozens of reputable lenders offering fast, easy loans over the internet. With most companies requiring only rudimentary information that is already recorded on your financial file to approve your loan request, applying online for a loan is simple and quick process with instant results.

But with so many online lenders out there, how do you find the right lender that will grant you a loan based on your specific circumstances and credit history without having to apply to each and every one?

Enter Monevo. Instead of directly providing a loan, it provides an online network that connects borrowers with top lenders. Currently Europe’s largest online lending marketplace with over 150 lenders in its network, Monevo now operates in the United States, allowing American borrowers to connect with some 30 thoroughly accredited, legitimate loan companies; compare and choose among various rates, terms, and services; and get approval for your personal loan quickly and hassle-free—all in one place and in just a matter of 60 seconds!

So, what makes Monevo head-and-shoulders above other similar aggregate lender websites out there? Monevo uses its award-winning algorithms to offer you the most up-to-date and accurate rates possible in real-time. This means that rather than giving you approximate, outdated, or bait-and-switch loan rate options like other sites (which may or may not match the actual loan offer you’re given in the end), Monevo connects you with partner lenders willing to accept your request at the exact moment you submit your request so you get the most updated and competitive—often lower—rates.

To search for a personal loan through Monevo, you can simply visit their site and fill out a free application. This step-by-step form allows you to choose the loan amount (from as little as $500 all the way up to $100,000), term (3 months to 144 months), and the purpose of your loan from a drop-down list. It will also ask for personal details (Name, Address, Date of Birth, Email Address, Social Security Number) as well as some details regarding your monthly home mortgage, pre-tax annual income, employment status, vehicle ownership status, credit scores, and education. Any information transmitted and/or stored is protected with SSL encryption and will not impact on your credit score.

Monevo’s powerful API then forwards this information to their lending partners (who may or may not require this data for a loan) and instantly returns real-time loan offers that fit your particular needs. These lenders will run a soft credit check to see your credit score and verify your identity. This process only takes a matter of seconds and does not affect your credit score since this this pre-qualification process only utilizes a soft pull, which will NOT show up on your credit report as an inquiry.

Afterwards, these offers will automatically be sorted by lowest APR (between 3.99% to 35.99%), allowing you to immediately see the most competitive offer for which you qualify. In general, the better your credit score is, the lower your interest rate will be.

From there, you can sort offers according to other specifications such as loan terms available, specific lenders who are making an offer, and even the total loan amount.

Once you thoroughly compare your offers and decide which one is right for you, you can click-through to complete the process. Monevo will transfer you to your chosen lender’s website where you will fill out any additional requirements, give your disbursement preferences, and even link up an online bank account for your monthly payments.

Terms

Monevo is a 100% FREE and no obligation service with no fees. The personal loan offers that appear on their website are from lending partners from which Monevo receives compensation for its services, tools, and facilities. Using Monevo does not impact your interest rates and Monevo does not influence where and how lender offers appear on your results page.

To search for a personal loan through Monevo, you must: be a US citizen or permanent resident; have a valid bank account in your name; be 18 years of age or older. After you receive your personalized offers, you can compare them through an organized, easily readable table that transparently shows you the interest rates, repayment term length, monthly repayment amount, and other loan details.

Monevo welcomes customers across all types of credit ratings from Poor to Excellent to apply for a loan with their carefully selected partners, although their minimum suggested FICO (Fair Isaac Corporation scores take into account 5 factors to determine creditworthiness: payment history, current level of indebtedness, types of credit used, length of credit history, and new credit accounts) score is 450 to 500.

Monevo lending partners offer some of the most flexible and generous loan amounts online, from $500 to a substantial $100,000. APRs (including fees related to originating the loan, not just the interest payments) range from 3.99% to 35.99% and repayment terms available between 3 months to 144 months.

To avail of a pre-qualified loan offer from a particular provider, simply click the link provided to go to their official website. The loan is then finalized (which may require additional documentation) and your funds are provided via direct deposit as soon as the next business day. Note that a preliminary loan offer from Monevo's network does not guarantee that is exactly what you will get when you complete your application since the loan details may change even after you get your initial offer.

And because Monevo does not provide the loans themselves; loan terms, costs, disbursements, interest rates, fees, and penalties are decided by Monevo's partner lenders. Any questions you have should be directed to the lender directly.

Trustworthiness

As of this article’s printing, Monevo has a rating of 5 stars out of 5 from The Credit Review; 4.6 stars out of 5 from Feefo.com’s 587 reviews; and 9.3 stars out of 10 from Doughroller.net. Meanwhile, Monevo’s OLA (Online Lenders Alliance) seal signifies its commitment to protecting its consumers against fraud and scams by providing a “scam alert” section on its website to let you know if a lender is being predatory. It also does not endorse any lenders and neither does it accept commissions for selecting a particular lender. This transparency is one of the reasons Monevo is rated highly by both users and industry professionals.

Furthermore, Monevo partners with big name, highly respected lenders and banks including LightStream, Avant, Barclays, Upgrade, One Main, Earnest, LoanMe, Lending Point, Prosper, Upstart, Marcus by Goldman Sachs, best egg, SoFi, PayOff, and more.

Conclusion

Since 2009, thousands of satisfied borrowers across the UK and Europe can attest to the reliable, trustworthy service of Monevo when it comes to finding the best, easiest, and quickest online loans. Now available in the US, Americans can use Monevo to apply for generous personal loan amounts of up to $100,000 and reasonable rates from 3.99% APR from your choice of over 30 highly respected, carefully vetted lenders and banks. Check out Monevo now and rest assured you’ll have a convenient loan platform to rely on in your time of need.

Monevo Blog

New Site Added: Monevo

by Mel

Jun 10, 2020

by Mel

Jun 10, 2020

Read More

Read More

Featured Sites

Visor

Visor is a tax-filing service company that can help you to optimize your taxes so you can maximize every possible deduction while saving some time and money. Aside from offering transparent pricing, it also provides year-round, one-on-one financial advising – simply schedule a session with your advisor.

Visor

Visor is a tax-filing service company that can help you to optimize your taxes so you can maximize every possible deduction while saving some time and money. Aside from offering transparent pricing, it also provides year-round, one-on-one financial advising – simply schedule a session with your advisor.

H&R Block

H&R Block is a tax company that provides all forms of tax-filing services you need so that you can do it yourself at home or you can visit one of many offices to consult with an expert in order to get your maximum tax refund.

H&R Block

H&R Block is a tax company that provides all forms of tax-filing services you need so that you can do it yourself at home or you can visit one of many offices to consult with an expert in order to get your maximum tax refund.

Turbo Tax

TurboTax is among the most popular tax-filing software company in the US. Aside from providing accurate and easy-to-use programs for you to file your taxes with, the company even offers tons of guarantees, free consultations, live tax advice, a referral system and more.

Turbo Tax

TurboTax is among the most popular tax-filing software company in the US. Aside from providing accurate and easy-to-use programs for you to file your taxes with, the company even offers tons of guarantees, free consultations, live tax advice, a referral system and more.

Even Financial

Even is a loan-matching service that offers personalized, fast-funding loan offers in 3 easy steps which can be completed within 10 minutes at most. The rates you get are reasonable, depending on your credit score, and they are very transparent about the terms of each of the loans they offer you.

Even Financial

Even is a loan-matching service that offers personalized, fast-funding loan offers in 3 easy steps which can be completed within 10 minutes at most. The rates you get are reasonable, depending on your credit score, and they are very transparent about the terms of each of the loans they offer you.

TaxSlayer

TaxSlayer is a tax-filing software that, according to its many customers, is the highest rated for best value. It offers a myriad of tax products, each of which are designed to fit a varying range of customers, from active-duty military personnel to freelancers. You can even file both your federal and state taxes for completely free if you qualify for a 1040EZ form.

TaxSlayer

TaxSlayer is a tax-filing software that, according to its many customers, is the highest rated for best value. It offers a myriad of tax products, each of which are designed to fit a varying range of customers, from active-duty military personnel to freelancers. You can even file both your federal and state taxes for completely free if you qualify for a 1040EZ form.

FreeTaxUSA

FreeTaxUSA is the only tax-filing service that lets you file your federal taxes for completely free regardless of which form you need to fill. Aside from promising accurate calculations and maximum and quick refunds, they are an IRS-approved e-file provider, allowing you to directly submit your tax return to the IRS for free as well.

FreeTaxUSA

FreeTaxUSA is the only tax-filing service that lets you file your federal taxes for completely free regardless of which form you need to fill. Aside from promising accurate calculations and maximum and quick refunds, they are an IRS-approved e-file provider, allowing you to directly submit your tax return to the IRS for free as well.