CrowdStreet

by Aethyna

Jun 26, 2019 |

0

Votes |

40

Used |

0

Reviews

by Aethyna

Jun 26, 2019 |

0

Votes |

40

Used |

0

Reviews

-

rate

Hailed as a disruptor of the commercial real estate industry, CrowdStreet aims to make previously out-of-reach commercial real estate investing more transparent, and available to the public and to accredited investors and qualified purchasers through crowdfunding.

Apply Now

Similar Sites

Used

-

rate

Hailed as a disruptor of the commercial real estate industry, CrowdStreet aims to make previously out-of-reach commercial real estate investing more transparent, and available to the public and to accredited investors and qualified purchasers through crowdfunding.

Apply Now

Similar Sites

Used

People Also Applied For

Summary

Hailed as a disruptor of the commercial real estate industry, CrowdStreet aims to make previously out-of-reach commercial real estate investing more transparent, and available to the public and to accredited investors and qualified purchasers through crowdfunding. By investing via CrowdStreet, investors can also build a diversified real estate portfolio a lot faster than before.

What You Get

As mentioned before, CrowdStreet strongly believes in the investment potential of commercial real estate (CRE) due to its history of being able to consistently outperform stocks and bonds. However, investing in CRE has always been an opportunity that’s reserved for the select few, who oftentimes either have the connections or are part of the upper echelons of society. CrowdStreet is here to change that!

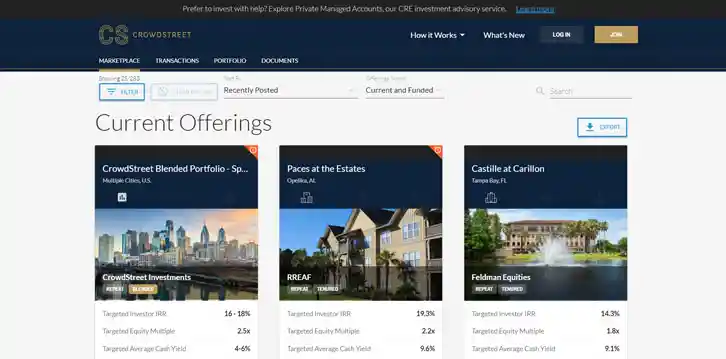

They provide their investors with highly-vetted CRE investment projects and the investors can even choose one of three methods to invest – Direct, Portfolio or Managed Investing. Direct Investing puts more control in the investors’ hands because they will be able to personally browse through the offers available on CrowdStreet and choose to invest in projects that meet their criteria. It can be time-consuming but if you’re really picky with your investments, this is the best way to go.

However, for those with little free time on their hands, you might be willing to relinquish some control and invest in a portfolio of 30 to 50 expert-reviewed offerings without having to browse through all of the CRE projects on offer. Portfolio Investing also allows you to easily diversify your investment without all the hassle of doing things individually.

What if you’re a little of both? In that case, you might want to opt for Managed Investing. In this method, you'll work with an Advisor at CrowdStreet to create a personalized investment plan that is right for you. CrowdStreet Advisors will build your portfolio and invest in deals for you. This scenario allows you to go about your daily life while your money is put to work for you.

All investors at CrowdStreet will have access to a Personal Investor Dashboard where you can monitor your investment performance. You can also easily exit an investment if you’re not happy with where it’s heading. You will get the remaining principal, if any, along with the final cash flows and potential gains on appreciation based on your investment agreement. The website itself even has a ton of helpful resources that the greenest of investors could make use of.

Note that although CrowdStreet doesn’t provide their own CREs projects for you to invest in; only through their sponsors, they do rigorously vet all the projects they receive, selecting only the legit and the best to be shown on their website. It has been said that only 5% of projects make it in front of potential investors like you.

That being said, several of their users have mentioned that it can be hard to get in on the best deals since these offers usually “close”, a.k.a. get funded, really quickly. So, if you want to best offers, you really need to be on your toes.

Terms

Crowdstreet requires their investors, except those who only want to invest in investment opportunities that are available under Regulation A (that’s open for all), to certify that they are indeed Accredited Investors or Qualified Purchasers.

As an investor, you should also understand that any form of investments has a range of associated risks, and this is more so when it comes to real estate and private investments. You should only invest what you can afford to lose, have a tolerance to high risks, low liquidity need, and are willing to stick around for the long-term in order to potentially see your investments bear fruit (or not).

CrowdStreet doesn’t seem to take a cut of your profits or even charge you a fee for investing, but they do provide advisory services (under a valid Advisory Services Agreement).

Trustworthiness

CrowdStreet seems to deliver on what they promised that is to provide rigorously-vetted CRE investment opportunities to potential investors who are looking to diversify their investment portfolio and maybe get some fantastic returns as well.

You can head over to their Marketplace Performance to view some numbers including the average realized returns, the target-vs-actual returns on various completed CRE projects, and more. They are very frank with the numbers, showing both “wins” and “losses”.

Conclusion

CrowdStreet is definitely a place you’d want to visit if you’re looking to get into CRE investing, especially if you’re new. The amount of educational resources available is astounding, and the staff there are really helpful when answering your questions. The three types of investment also allow for some flexibility when you’re deciding how to invest.

But of course, the ultimate cherry on top is how attractive the investment opportunities CrowdStreet has to offer. All of them are highly-vetted by experts and, despite giving no guarantees in the returns, many of these projects seem to achieve or even exceed the targeted percentage of return that the site predicted. Worth your investment dollars, that’s for sure!

CrowdStreet Blog

New Site Added: CrowdStreet

by Aethyna

Jun 26, 2019

by Aethyna

Jun 26, 2019

Read More

Read More

Featured Sites

Visor

Visor is a tax-filing service company that can help you to optimize your taxes so you can maximize every possible deduction while saving some time and money. Aside from offering transparent pricing, it also provides year-round, one-on-one financial advising – simply schedule a session with your advisor.

Visor

Visor is a tax-filing service company that can help you to optimize your taxes so you can maximize every possible deduction while saving some time and money. Aside from offering transparent pricing, it also provides year-round, one-on-one financial advising – simply schedule a session with your advisor.

H&R Block

H&R Block is a tax company that provides all forms of tax-filing services you need so that you can do it yourself at home or you can visit one of many offices to consult with an expert in order to get your maximum tax refund.

H&R Block

H&R Block is a tax company that provides all forms of tax-filing services you need so that you can do it yourself at home or you can visit one of many offices to consult with an expert in order to get your maximum tax refund.

Turbo Tax

TurboTax is among the most popular tax-filing software company in the US. Aside from providing accurate and easy-to-use programs for you to file your taxes with, the company even offers tons of guarantees, free consultations, live tax advice, a referral system and more.

Turbo Tax

TurboTax is among the most popular tax-filing software company in the US. Aside from providing accurate and easy-to-use programs for you to file your taxes with, the company even offers tons of guarantees, free consultations, live tax advice, a referral system and more.

Even Financial

Even is a loan-matching service that offers personalized, fast-funding loan offers in 3 easy steps which can be completed within 10 minutes at most. The rates you get are reasonable, depending on your credit score, and they are very transparent about the terms of each of the loans they offer you.

Even Financial

Even is a loan-matching service that offers personalized, fast-funding loan offers in 3 easy steps which can be completed within 10 minutes at most. The rates you get are reasonable, depending on your credit score, and they are very transparent about the terms of each of the loans they offer you.

TaxSlayer

TaxSlayer is a tax-filing software that, according to its many customers, is the highest rated for best value. It offers a myriad of tax products, each of which are designed to fit a varying range of customers, from active-duty military personnel to freelancers. You can even file both your federal and state taxes for completely free if you qualify for a 1040EZ form.

TaxSlayer

TaxSlayer is a tax-filing software that, according to its many customers, is the highest rated for best value. It offers a myriad of tax products, each of which are designed to fit a varying range of customers, from active-duty military personnel to freelancers. You can even file both your federal and state taxes for completely free if you qualify for a 1040EZ form.

FreeTaxUSA

FreeTaxUSA is the only tax-filing service that lets you file your federal taxes for completely free regardless of which form you need to fill. Aside from promising accurate calculations and maximum and quick refunds, they are an IRS-approved e-file provider, allowing you to directly submit your tax return to the IRS for free as well.

FreeTaxUSA

FreeTaxUSA is the only tax-filing service that lets you file your federal taxes for completely free regardless of which form you need to fill. Aside from promising accurate calculations and maximum and quick refunds, they are an IRS-approved e-file provider, allowing you to directly submit your tax return to the IRS for free as well.